Advanced Trading Account

Advanced Trading Account / Mechanical trading systems

Algorithmstocktrade Trade has been sharing financial freedom with traders since 2014. In a continuous effort to give traders a more comfortable and safe experience, its experts have been improving the platform ensuring traders can enjoy and make use of that freedom to trade whenever and wherever they like.

Advanced Trading Account

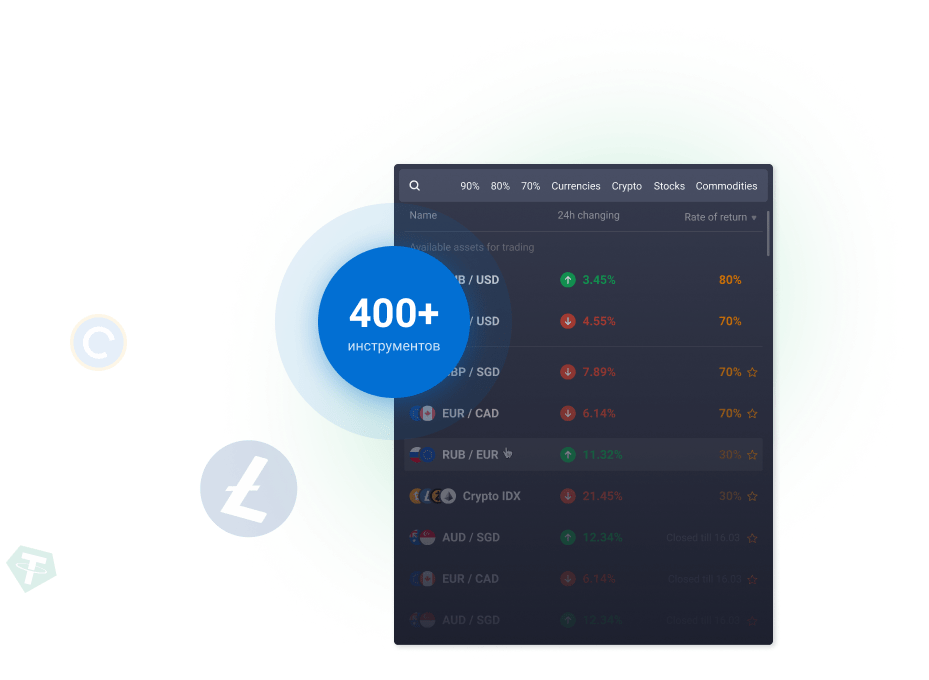

Advanced Trading Account also referred to as mechanical trading systems, algorithmic trading, automated trading or system trading — allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. In fact, various platforms report 70% to 80% or more of shares traded on U.S. stock exchanges come from automatic trading systems.

Traders and investors can turn precise entry, exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met.

The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific to the user's trading platform. They can also be based on the expertise of a qualified programmer.

Advantages of Automated Systems

Minimizing Emotions

Automated trading systems minimize emotions throughout the trading process. By

keeping

emotions in check, traders typically have an easier time sticking to the plan.

Since

trade orders are executed automatically once the trade rules have been met,

traders

will

not be able to hesitate or question the trade. In addition to helping traders

who

are

afraid to "pull the trigger," automated trading can curb those who are apt to

overtrade

— buying and selling at every perceived opportunity.

Backtesting

Backtesting applies trading rules to historical market data to determine the

viability

of the idea. When designing a system for automated trading, all rules need to be

absolute, with no room for interpretation. The computer cannot make guesses and

it

has

to be told exactly what to do. Traders can take these precise sets of rules and

test

them on historical data before risking money in live trading. Careful

backtesting

allows

traders to evaluate and fine-tune a trading idea, and to determine the system's

expectancy – i.e., the average amount a trader can expect to win (or lose) per

unit

of

risk.

Although appealing for a variety of reasons, automated trading systems should not be considered a substitute for carefully executed trading. Technology failures can happen, and as such, these systems do require monitoring. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems.

Translate

Translate